EPFO had introduced The Pradhan Mantri Rojgar Prot...

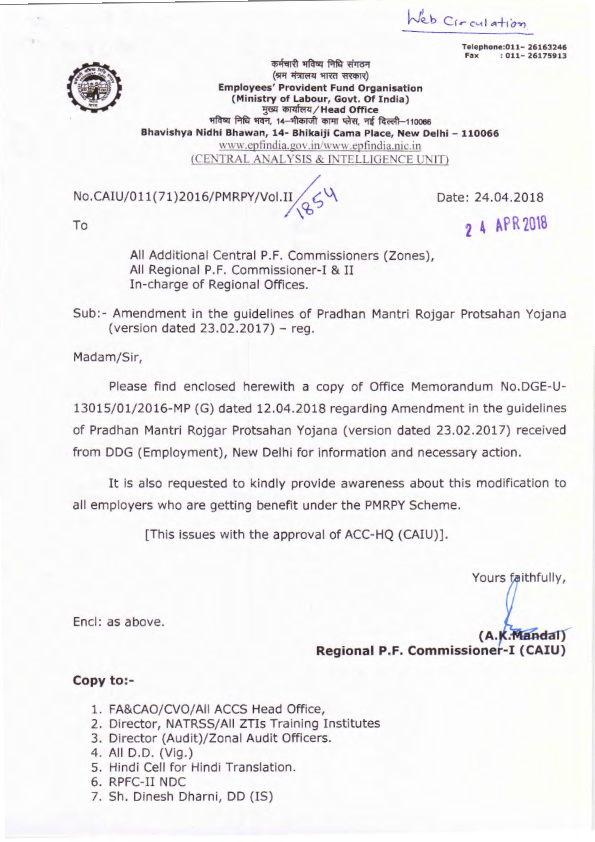

EPFO had introduced The Pradhan Mantri Rojgar Protsahan Yojna (PMRPY) W.E.F 01/04/2016 to incentivize employers to generate new employment. As per the earlier guidelines govt. of India were paying 8.33% of the employer's (who have registered under PMPRY) EPS contributions for eligible employees. As per the new amendment dt. 12/04/2018, Govt. of India will pay entire employers' contribution of 12% (EPF & EPS) for the new employees who are employed on or after 01/04/2018 in establishments covered under the EPFO and drawing less than Rs.15000/- as Gross Wages. Benefit for Existing beneficiaries would continue for their remaining period of three years. Registration of beneficiary through establishment shall terminate on 31st March 2019. The conditions shall remain same as follows: Condition: 1) Employees should be first registered under PF having Gross salary not more than Rs. 15000/- 2) Aadhaar Card and Pan Card for verification. 3) To avail the benefit, payment of PF contribution should be made before 10th of every month. 4) Digital Signature for approval 5) Labour Identification Number (LIN) from Shram Suvidha Portal of Ministry of Labour & Employment, Government of India. Registration under PMRPY Compulsory: An employer have to compulsorily register with PMRPY Portal. Our charges for getting your organisation registered under PMPRY are Rs. 500 + GST. Similarly for employee registration, it would be - Rs. 750 + GST per employee. This is a very beneficial scheme introduced by EPFO. Many organisations have availed great benefits. With the amendment, the benefits that an organisation can avail has increased further to 12%. Please avail this benefit for your new employees having Gross salary less than Rs. 15000/-.

Keywords

Subscribe for latest offers & updates

We hate spam too.